Margin Loan Calculator

Calculate margin requirements, interest costs, and risk scenarios for stock trading

Margin Trading Basics: Use borrowed funds from your broker to purchase securities. This amplifies both gains and losses.

Margin Loan Result

Margin Loan Amount

Amount borrowed from broker

Formula: Loan Amount = (Total Purchase × (1 – Margin Requirement))

Interest Costs: Calculate the cost of borrowing on margin over time. Interest rates vary by broker and loan size.

Interest Cost Result

Total Interest

Interest paid over loan period

Break-even Analysis: Your investment needs to grow by 0% to cover interest costs.

Important: Interest compounds daily on margin loans. This calculation provides an estimate only.

Risk Scenarios: See how different price movements affect your account value and potential margin calls.

Risk Scenario Analysis

| Price Change | Account Equity | Margin Level | Status |

|---|

Margin Call Warning: If your account equity falls below the maintenance requirement, you’ll receive a margin call and may need to deposit more funds or sell securities.

Maintenance Margin: Calculate the minimum account equity required to avoid a margin call based on your positions.

Maintenance Margin Result

Current Equity

Account value minus loan amount

Margin Call Price: Your portfolio value would need to drop to $0.00 to trigger a margin call.

Status: Your account is currently above the maintenance requirement.

Frequently Asked Questions

A margin loan is money borrowed from a brokerage firm to purchase securities. The loan is collateralized by the securities in your investment account and cash.

Margin loans allow investors to leverage their positions, potentially amplifying returns but also increasing risk.

Example: With $10,000 in your account and a 50% margin requirement, you could borrow up to $10,000 to purchase $20,000 worth of securities.

A margin call occurs when the equity in your margin account falls below the broker’s required minimum (maintenance margin).

- Initial Margin: Minimum equity required when opening a position (typically 50%)

- Maintenance Margin: Minimum equity required to keep a position open (typically 25-30%)

To avoid margin calls:

- Use conservative leverage (2:1 or less)

- Monitor your positions regularly

- Maintain a cash buffer in your account

- Use stop-loss orders to limit losses

Margin interest is typically calculated daily based on the outstanding loan balance and compounded monthly.

Key factors affecting margin interest:

- Loan Amount: Larger loans generally have lower rates

- Broker Policies: Rates vary significantly between brokers

- Market Conditions: Rates may change with interest rate environment

Important: Margin interest is tax-deductible for investment purposes, but there are limitations. Consult a tax professional.

Margin trading carries significant risks that every investor should understand:

- Amplified Losses: Losses can exceed your initial investment

- Margin Calls: Forced liquidation at unfavorable prices

- Interest Costs: Ongoing expenses reduce net returns

- Volatility Risk: Rapid price movements can trigger margin calls quickly

- Psychological Pressure: Leverage can lead to emotional decision-making

Risk Warning: Margin trading is not suitable for all investors. You can lose more money than you initially deposit.

Successful margin traders use several risk management strategies:

- Conservative Leverage: Use 2:1 leverage or less for most positions

- Diversification: Avoid concentrating too much in one position

- Stop-Loss Orders: Automatically exit positions at predetermined prices

- Regular Monitoring: Check margin levels frequently

- Cash Reserves: Maintain extra cash to meet potential margin calls

- Position Sizing: Limit margin usage to a small percentage of total portfolio

The most important rule: Never use more margin than you can afford to lose.

Ultimate Guide to Using a Margin Loan Calculator for Smarter Trading

Hey there, fellow trader! Have you ever stared at your brokerage account, wondering if borrowing a bit more cash could supercharge your stock plays? That’s where margin loans come in, they’re like a turbo boost for your investments.

But let’s be real: diving into margin trading without the right tools is like driving blindfolded. Enter the margin loan calculator, a handy online tool that crunches the numbers for you.

What Exactly Is a Margin Loan?

First things first—let’s break down the basics. A margin loan is essentially money you borrow from your broker to buy more stocks, ETFs, or other securities than you could with just your own cash. Think of it as using your existing investments as collateral for a loan.

According to sources like Fidelity and Charles Schwab, this setup lets you amplify your buying power. For instance, if you have $50,000 in your account and your broker allows 50% margin, you might borrow another $50,000 to invest a total of $100,000.

But it’s not free money. You pay interest on what you borrow, and there are rules set by regulators like FINRA. The initial margin requirement is usually 50%—meaning you must put up half the purchase price yourself.

Then there’s the maintenance margin, often 25-30%, which is the minimum equity you need to keep in your account to avoid trouble. If your investments drop in value, you could face a margin call, where the broker demands more cash or forces you to sell assets.

Why do people use them? Well, in a rising market, margins can magnify gains. Say a stock jumps 20%: on a $10,000 cash investment, that’s $2,000 profit. But with margin doubling your stake to $20,000, you’d pocket $4,000 (minus interest). Sounds tempting, right? Just remember, losses get amplified too.

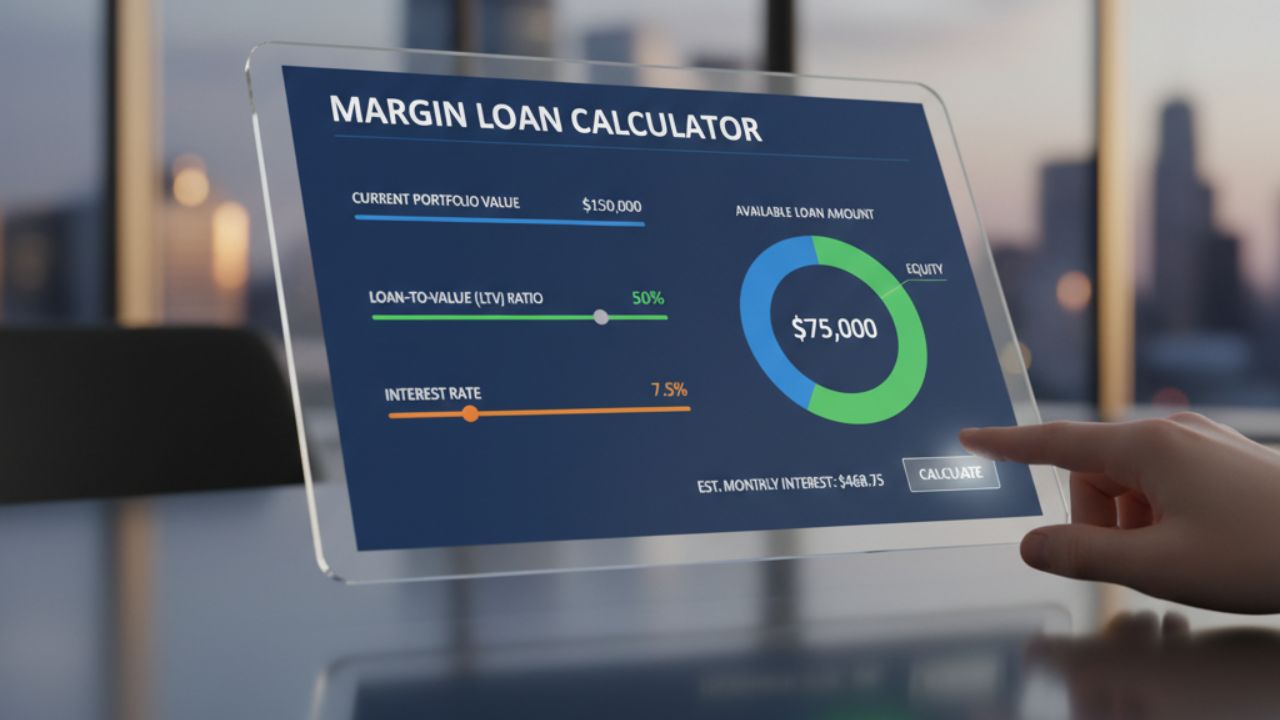

Why Bother with a Margin Loan Calculator?

Trading on margin isn’t guesswork—you need precise calculations to stay safe. That’s where a margin loan calculator shines. These tools help you figure out how much you can borrow, what it’ll cost in interest, and what happens if the market turns against you. Without one, you might overestimate your buying power or underestimate risks, leading to nasty surprises.

From my research on sites like Investopedia and SoFi, calculators make complex math simple. They factor in variables like your account value, stock prices, interest rates, and loan duration.

Plus, they’re great for scenario planning: What if stocks drop 10%? Will you get a margin call? Using one promotes smarter decisions, helping you avoid over-leveraging. In short, it’s like having a financial co-pilot.

Key Features to Look for in a Margin Loan Calculator

Not all calculators are created equal. A top-notch one, like the interactive HTML-based tool we’re referencing here, packs multiple functions into one sleek interface. It uses tabs for easy navigation, covering basics to advanced risks. Here’s what stands out:

- Basic Calculator Tab: Inputs for account value, margin requirement (like 50% for 2:1 leverage), stock price, and shares. Outputs show loan amount, buying power, and leverage ratio.

- Interest Calculator Tab: Factors in loan amount, annual rate (options like 6-12%), and duration in months. It spits out total interest, monthly costs, and break-even points.

- Risk Scenarios Tab: Simulates price changes (-40% to +20%) on your portfolio, showing equity, margin levels, and status (e.g., “OK” or “Margin Call”).

- Maintenance Margin Tab: Checks if your equity meets requirements, calculating buffers and drop thresholds before a call.

The design is user-friendly, with visuals like risk meters (green for low, red for high) and breakdowns in grids. It even includes quick-select buttons for leverage and rates, making it accessible for intermediate users.

Step-by-Step: Using the Basic Margin Calculator

Let’s get hands-on. Suppose you’re eyeing a stock at $100 per share and want 500 shares—that’s a $50,000 buy. With $50,000 in your account, could you pull it off on margin?

- Enter Your Account Value: Plug in $50,000.

- Choose Margin Requirement: Select 50% (2:1 leverage) from options.

- Input Stock Details: $100 price, 500 shares.

- Hit Calculate: The tool does the magic.

Results? Loan amount: $25,000 (half the purchase). Total buying power: $50,000. Your investment: $25,000. Leverage: 2:1. A risk meter might show “low” if leverage is conservative.

From Schwab’s guidelines, remember the formula: Loan Amount = Total Purchase × (1 – Margin Percentage). Here, Margin Percentage is 0.5, so Loan = $50,000 × 0.5 = $25,000. Easy peasy, and it prevents you from biting off more than you can chew.

| Input | Value | Output | Result |

|---|---|---|---|

| Account Value | $50,000 | Loan Amount | $25,000 |

| Margin Req. | 50% | Buying Power | $50,000 |

| Stock Price | $100 | Your Investment | $25,000 |

| Shares | 500 | Leverage Ratio | 2:1 |

This table sums it up—use it to visualize your trades.

How to Calculate Margin Interest Costs

Interest is the sneaky cost of margin loans. Brokers charge annual rates from 6-12% or more, calculated daily but compounded monthly. A good calculator simplifies this.

Take our tool’s interest tab: Input $25,000 loan, 8% rate, 12 months. It outputs total interest: about $2,000 (using simple formula: Loan × Rate × Time). Monthly payment: ~$166. Break-even: Your investments need ~8% growth to cover costs.

Per Investopedia, the daily interest formula is (Balance × Rate) / 365. For accuracy, check your broker—rates vary, like Schwab’s tiered system. Pro tip: Pay down loans quickly to minimize charges, as they can eat into profits.

- Low Rate (6%): Great for long holds; low cost.

- High Rate (12%): Risky; only for short-term bets.

Always factor this in—interest can turn a winner into a loser.

Diving into Risk Scenarios: What If the Market Drops?

Margin trading’s thrill comes with chills. The risk scenarios tab in our calculator lets you stress-test your portfolio. Input $50,000 account, $25,000 loan, 30% maintenance req.

It generates a table for price changes:

| Price Change | Account Equity | Margin Level | Status |

|---|---|---|---|

| -20% | $40,000 | 40% | OK |

| -30% | $35,000 | 35% | Warning |

| -40% | $30,000 | 30% | Margin Call |

From Fidelity’s warnings, if equity dips below maintenance (say 25%), expect a margin call. You might sell at a loss or add cash. Risks? Amplified losses, forced sales in volatile markets. Schwab notes your downside isn’t capped at collateral—losses can exceed deposits.

Use this to gauge tolerance: If a 10% drop scares you, dial back leverage.

Mastering Maintenance Margin Requirements

Maintenance margin is your safety net. Regulators require at least 25%, but brokers often bump it to 30% for stocks. Our calculator’s tab checks this: Enter $50,000 account, $30,000 loan, $80,000 portfolio, 30% req.

Outputs: Current equity $50,000; Minimum $24,000; Buffer $26,000; Drop before call ~32.5%.

Formula from Corporate Finance Institute: Min Equity = Portfolio Value × Req. If you fall short, margin call looms. SoFi explains higher reqs for volatile stocks (up to 100% for penny stocks).

Track this daily—market swings happen fast.

Best Practices for Safe Margin Trading

Don’t wing it. From Schwab and Investopedia, here are tips:

- Start Small: Limit margin to 20-30% of your portfolio.

- Diversify: Spread bets; avoid all-in on one stock.

- Monitor Daily: Use alerts for margin levels.

- Set Stops: Auto-sell at loss thresholds.

- Borrow Conservatively: Stick to 2:1 leverage for beginners.

- Have Cash Ready: Buffer for calls.

- Understand Costs: Factor interest and fees.

Vanguard advises using margin for strategic buys, not speculation. Remember, it’s a tool—not a shortcut to riches.

Common Questions About Margin Loans

What’s the difference between initial and maintenance margin?

Initial (50%) is for buying; maintenance (25-30%) is to hold. Drop below, and call time.

How do I avoid margin calls?

Keep equity high, use stops, monitor volatility. Fidelity suggests conservative borrowing.

Is margin interest tax-deductible?

Often yes, for investments—chat with a tax pro.

Who should use margin?

Experienced traders with risk tolerance. Not for newbies or retirement funds.

What if I can’t meet a call?

Broker sells assets, possibly at loss. Ouch.

Conclusion

There you have it—a deep dive into margin loan calculators. These tools demystify borrowing, from basic loans to risk forecasts, helping you trade smarter. Whether crunching interest or simulating crashes, they’re invaluable for intermediate folks like us. Just remember: Margin amplifies everything, good and bad. Start slow, learn your broker’s rules, and always calculate before committing.

Disclaimer: This blog is for informational purposes only and not financial advice. Margin trading involves significant risks, including potential loss of more than your initial investment. Consult a qualified advisor before using margin loans. The author and publisher are not responsible for any losses incurred.